Key Topics: PCI compliance Canada, pay at the pump security, gas station EMV upgrade, PCI DSS fuel dispensers

What Is PCI Compliance?

PCI Compliance refers to adherence to the Payment Card Industry Data Security Standard (PCI DSS)—a global set of security standards developed by major credit card companies (Visa, Mastercard, American Express, Discover, and JCB). These standards are designed to ensure that all businesses that store, process, or transmit credit card information maintain a secure environment.

Key Objectives of PCI DSS:

- Protect cardholder data

- Maintain a secure network

- Implement strong access control measures

- Regularly monitor and test networks

- Maintain an information security policy

Whether you're a multinational retailer or a single-location gas station, if you accept card payments, PCI DSS applies to you.

PCI Compliance in Canada: What’s Different?

While PCI DSS is a global standard, Canadian businesses must also consider:

- PIPEDA (Personal Information Protection and Electronic Documents Act): This federal privacy law governs how businesses handle personal information, including payment data.

- Interac and EMV standards: In Canada, debit transactions often use Interac, which has its own security protocols. EMV (Europay, Mastercard, and Visa) chip technology is also widely adopted and required for compliance.

Canadian gas station owners must ensure their payment systems meet both PCI DSS and Canadian privacy laws to avoid legal and financial risks.

Pay-at-the-Pump Security: Why PCI DSS Matters

Unattended payment terminals at fuel dispensers—commonly known as pay-at-the-pump systems—are prime targets for fraud, including card skimming and data breaches.

PCI DSS Requirements for Fuel Dispensers:

- Use of EMV-compliant terminals (chip-enabled)

- Encryption of cardholder data

- Tamper-resistant hardware

- Regular security updates and monitoring

Risks of Non-Compliance:

- Increased vulnerability to fraud

- Liability for data breaches

- Loss of customer trust

- Hefty fines from card networks

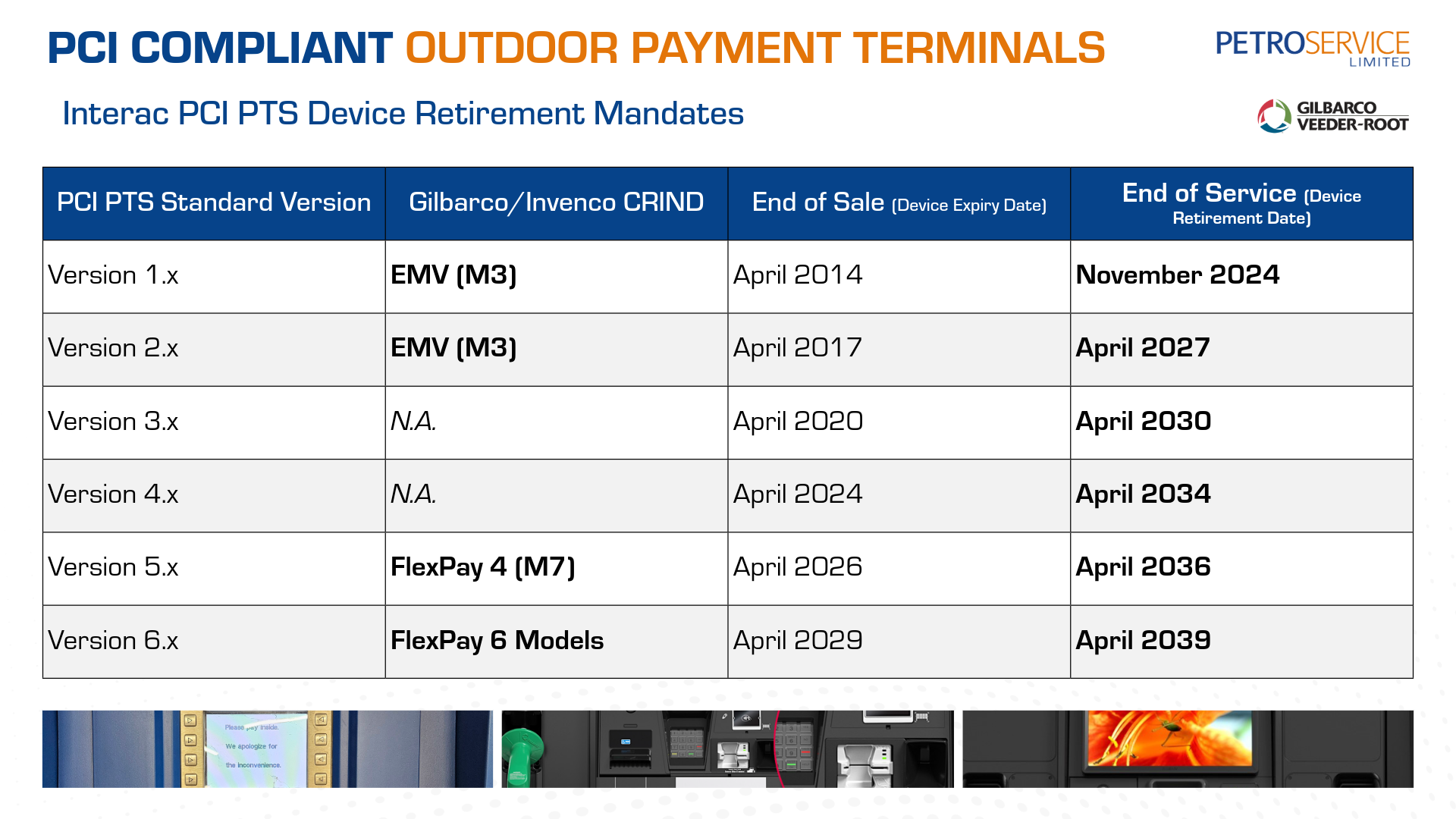

PCI 2.0 Sunsetting in 2027: What It Means for You

As of 2027, PCI 2.0-compliant EMV SPOT terminals will no longer meet PCI DSS standards. This means that any gas station still using these terminals will be out of compliance and at risk.

What You Need to Do:

- Upgrade to PCI 3.x or higher terminals

- Consider solutions like FlexPay IV (compliant until 2036)

- Work with certified providers like Petroservice to retrofit or replace outdated equipment

Why PCI Compliance Matters

Benefits of Compliance:

- Reduced fraud and chargebacks

- Enhanced customer trust and loyalty

- Avoidance of costly fines and legal issues

- Improved operational security

Consequences of Non-Compliance:

- Fines ranging from $5,000 to $100,000 per month

- Liability for fraudulent transactions

- Damage to your brand reputation

- Potential loss of ability to process card payments

Staying PCI compliant isn’t just a technical requirement—it’s a business-critical investment in your station’s future. With the 2027 PCI 2.0 sunset approaching, now is the time to audit your current systems, plan your upgrades, and partner with trusted providers to ensure your site is secure and compliant.

Need help with your gas station EMV upgrade or PCI compliance strategy? Connect with Petroservice to explore your options.